The Dynamic Dividend

Why traditional global wealth managers are betting on regional manufacturing and how the opportunity is bigger than just returns

The investment theses that guided institutional capital for decades assumed a stable world: predictable trade relationships, concentrated manufacturing hubs, and the premise that globalization's trajectory only pointed one direction. That world is gone. But what's emerging isn't chaos. It's opportunity.

The signals are everywhere. COVID exposed the fragility of extended supply chains. Tariff regimes have accelerated a reshaping of trade flows. And events like the recent U.S. action in Venezuela, whatever your read on the politics, underscore that the rules governing international conduct are being rewritten in real time. The old playbook assumed stasis. The new reality demands agility.

Here's what the smartest institutional investors are beginning to recognize: this isn't a temporary disruption to wait out. It's a structural shift that rewards those who move first. Sovereign wealth funds, family offices, and long-horizon allocators built their strategies around a world that rewarded patience and scale. Now, the advantage goes to those who can identify technologies that travel—systems designed for regional deployment rather than centralized mega-production.

This is where the opportunity gets concrete.

The advanced manufacturing technologies emerging today share a common profile: modular architectures, electrified processes, and capital requirements that are a fraction of legacy industrial plants. A next-generation energy system doesn't require a city-sized facility and a decade of construction. It can be deployed regionally, scaled incrementally, and adapted to local conditions. The implications for institutional investors are profound. Technology transfer is never simple, but modular systems are architecturally different from the vertically-integrated mega-plants of the last industrial era. Their smaller scale and standardized components make regional deployment feasible in ways it wasn't before. You can back a company developing breakthrough technology in one geography and, within years, license or deploy that capability closer to home. The value creation doesn't have to stay concentrated in one place.

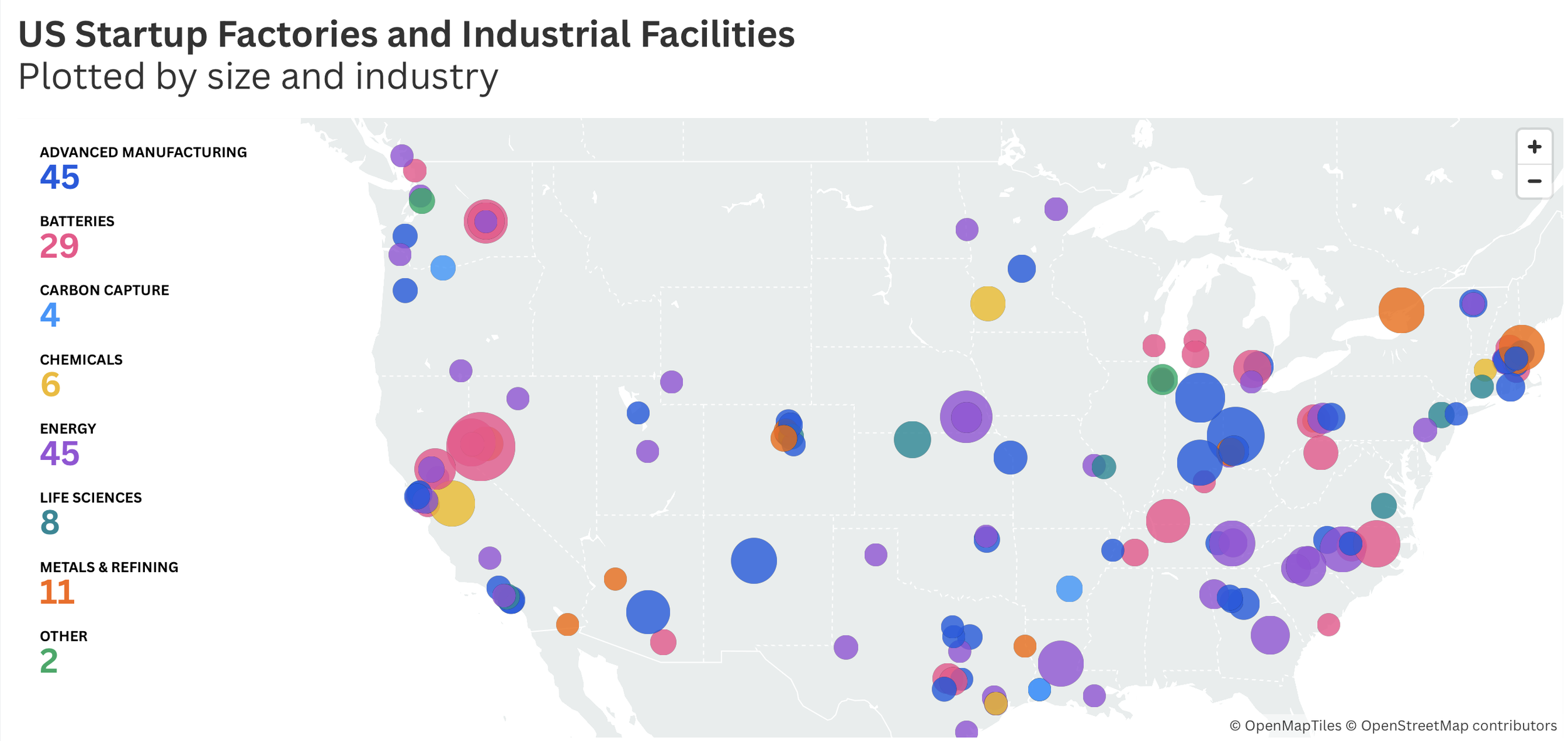

Venture backed advanced manufacturing facilities in the United States that will expand internationally within the decade.

Some will argue this misses the bigger picture. "The future belongs to AI and software," they'll say. "Physical manufacturing is yesterday's game. Let someone else handle it." It's a seductive thesis, but it's incomplete. You cannot build data centers without advanced materials. You cannot power AI without energy infrastructure someone must manufacture. The question isn't whether deep tech matters. It's whether you'll build the capacity to produce it or depend on supply chains you don't control.

The path the United States is charting in reindustrialization offers a template. The modular technologies being commercialized here aren't designed for American factories alone. They're designed to travel. For investors evaluating where to deploy capital in a more dynamic world, this creates a genuinely new category: back the innovation, then bring the production home.

Advanced technologies are reshaping entire industries including energy, consumer good and critical infrastructure.

Countries are already drawing this conclusion. Industrial policy is resurging across Europe, Asia, and the Middle East. The question isn't whether reindustrialization will happen. It's who captures the value as supply chains reorganize.

The investors positioned to benefit share a common insight: in a world where you can no longer bet on stability, you bet on adaptability. Technologies that can be deployed anywhere. Systems that scale without billion-dollar commitments. Manufacturing approaches that create economic benefit wherever they land.

The old equilibrium isn't coming back. What's emerging is the largest reallocation of industrial value in generations. The question is whether you'll help shape it or watch from the sidelines.